Jakob Aarup Petersen

Sydbank

Group Executive Vice President, Operations

Human-Centric Digital Transformation

- Agile self-organized teams

- Human-Centricity (employees & customers)

- Micro innovation

- Enterprise Architecture

- Digital Transformation

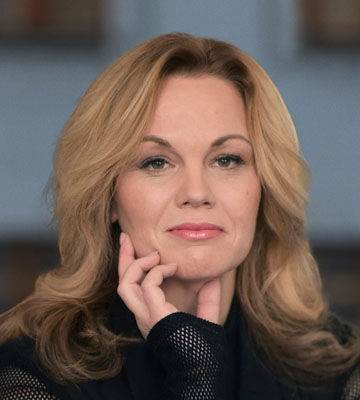

Izabela Firlej

Nordea

Head of Monitoring, Reporting & Analytics

Is it still relevant to manage operational risk within a modern set up of operations?

- What kind of operational risk we are facing nowadays?

- How to monitor operational risk within financial institution?

- Which tools and technics can be applicable to manage operational risk within a modern set up of operations?

Jitka Haubová

Komerční banka

Chief Operations Officer & Member of Management Board

Transforming Back Office in digital age - From legacy to innovation

- Online processing almost only and Change of the key tech components in payments and core systems

- Cheaper cash processing as regulatory duty and ATM´s sharing with other 5 banks

- Upgrade Processing centres from manual and repeatable paper-based work to having very flexible teams with professional expertise providing value-added services within the digital environment

- Digital onboarding and online KYC processes

- HO working as a standard in Operations

Olivier Blanc

State Street Bank

COO & Head of Global Delivery France

Sustainable practices in Back Office operations: Ways to improve service quality, efficiency, and security

- What are the Operations transformation key drivers?

- Set objectives with OKR, agile @scale for Operations, to be more client-centric or process-driven, including their digitalization.

- Testimonies on driving transformation and these approaches in Operations.

Dragos Codrut Badea

Erste Group

Agile Transformation Coach

Agile Transformation - emphasises collaboration, flexibility, and continuous improvement in Banking operations

- Overview of the bank and the need for transformation.

- Encouragement of team collaboration through shared goals and accountability.

- Empowerment of teams to make decisions quickly and adapt to changing requirements.

- Support a culture of continuous improvement through regular training and skill development.

- Implementation of a feedback loop from customers to ensure that the products and services continuously evolve to meet their needs.

- Integration of modern technology solutions to support Agile practices, such as automated testing and continuous integration.

- Use of data analytics to drive decision-making and improve operational efficiency.

- Improved time-to-market for new products and services.

- Enhanced customer satisfaction due to more responsive and tailored offerings.

- Increased employee engagement and productivity through a collaborative and empowering work environment.

Dr. Peter Quell

DZ BANK AG

Head of Portfolio Analytics for Market Risk and Credit Risk

Deploying data analytics in Market Risk to gain insights and improve processes

- Characteristics of financial time series

- Filtering, an ancient AI application?

- Potential of generative AI in risk forecasting

- Some thoughts on Model Risk

Ben Dunne

Santander

Product Proposition Manager

Managing risk through delivering at pace

- Driving operational resilience in the face of Market Disruptions

- The potentials risks of using emerging technologies in Back Office operations - AI, ML, RPA, Metaverse

- Mitigating risks through secure and streamlined processes – BPM, Cloud migration, Process Mining, Agile framework etc.

As banks shift from legacy systems to innovative solutions, the focus will be on enhancing efficiency and customer experience. Attendees will engage in thought-provoking discussions, explore the latest trends in automation and digital transformation, and learn how emerging technologies like AI, blockchain, and hyperautomation can drive operational excellence. Network with industry leaders and gain insights into best practices and strategies that optimize banking operations for the future. Don’t miss this opportunity to reshape your organization’s back office.